ESG (environmental, social and governance) was first introduced in the 1960s, evolving and gaining momentum over time. From investing to data reporting, to performance and supply chain management, it is only natural that architecture and urbanism has been brought into the fold.

Recently, mounting pressure around sustainability and climate change has made one thing clear: ESG reporting is no longer a nice-to-have, it is a must-have. If you need convincing, as of 2023, 96% of S&P 500 companies are engaged in voluntary ESG reporting, and with this rise in popularity comes new ambitions and pressures. The public is no longer impressed by companies that simply have an ESG report; they now want to know the intimate details of those reports and how a company’s performance stacks up against competitors. This has been supported by the development of ESG regulations and increasingly stringent frameworks like the Global Reporting Initiative (GRI), CDP, Sustainability Accounting Standards Board, and the Task Force on Climate-Related Financial Disclosures. For example, if a company wants to meet GRI Disclosure 302-1 requirements on energy consumption within the organization, it will have to provide the total fuel consumption for both renewable and non-renewable sources in specific units of measure, broken down by end-use, and detailing the specific standards, methodologies, and conversion factors used to complete the analysis. This means we cannot use renewable energy to make up for the sins of the architecture.

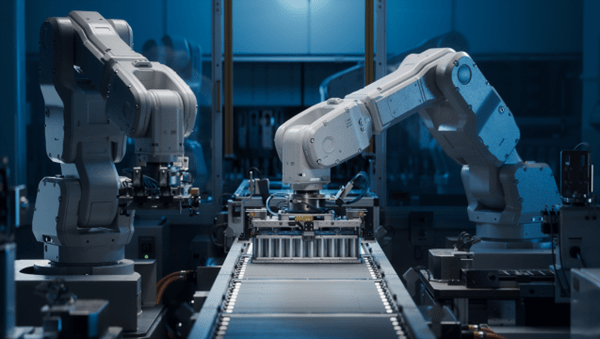

While these frameworks allow for more standardized reporting, they do not on their own demonstrate that a company is performing more sustainably. That responsibility falls directly onto each individual organization, primarily its executives, who are expected to lead their company through organizational changes. Successful companies will then be able to demonstrate improvement by releasing updated performance data in each subsequent reporting cycle. Completing such rigorous reports requires a higher level of corporate governance (and time and expertise) than has previously existed. In anticipation of these rising demands, many organizations have begun to build out policies, teams and data management systems to manage this level of reporting. In the context of architecture and urbanism, this conversation has been focused on green building standards, intelligent building systems, performance monitoring, and digital twins.

How Green Building Standards Support ESG:

Environmental

- LEED

- BREEAM

Social

- WELL

- Fitwel

Governance

- WiredScore

- SmartScore

People spend about 90% of their time indoors. Whether for shelter, storage, manufacturing, living or working spaces, our society depends on buildings—just look around and you will find that everything you see has been influenced in some way, shape or form by buildings. Even the virtual cloud is housed on servers that are physically stored inside a building. As a result, the built environment is responsible for about 75% of global greenhouse gas emissions, becoming a critical component of most, if not all, ESG reports.

However, sustainability in the built environment is far from new. Architects, planners, and engineers have been building up the practice for decades. While some may argue that green building standards like BREEAM and LEED paved the way, the reality is that sustainable design has been around since the beginning of civilization. For example, vernacular design, a practice which leverages local customs, materials, climate, and even geography to develop a built environment that is not only functional, but also inextricably linked to the culture and community, has been around as long as architecture.

One could argue that it was the industrial revolution and the rise of technology that disconnected the built environment from sustainable practices. Instead of constructing buildings that naturally heat and cool, we created HVAC systems to artificially control indoor air, which allowed us to build bigger buildings, anywhere in the world, faster. We then developed building codes, zoning by-laws, financing structures and project delivery methods that were so dependent on these modern technologies that they became inflexible and all but eliminated basic bioclimatic design practices.

However, ESG is injecting new life into the conversation by making sustainability part of brand identity, forcing organizations to stop looking at sustainability as a project-specific issue and instead as a systemwide issue. In other words, problems that were once deemed too challenging to resolve for the sake of one project alone are now seen as opportunities to leverage economy of scale across a full portfolio. Not only does this enable us to explore a wider range of technical solutions, but it also challenges us to re-examine how we have come to build buildings over the past couple of decades. This type of thinking is already leading to new partnerships, new business models, and a general re-writing of the status quo.

Holistic ESG-level solutions must examine the full portfolio, including both new and existing buildings. While new buildings may at first appear easier to work with, all new buildings do eventually become existing buildings, and as ESG reporting becomes more stringent and societal expectations continue to evolve, new buildings will have to continually address these moving goal posts. This can be managed by prioritizing long-term commitments over short-term commitments. For example, choosing to build in a flood plain is a long-term commitment – a poor one. Selecting a structural system and compatible building envelope is a long-term commitment. Choosing how to proactively address gentrification is a long-term commitment. On the other hand, mechanical systems, interior finishes, communication systems, or even partition walls are all short-term commitments that provide regular opportunities for renovation and sustainability improvements. Looking at new buildings as dynamic products allows us to prioritize sustainability in the long-term commitments that we make, while also reducing operational costs and the risk of asset abandonment in the future.

Existing buildings, especially those that are not future-proofed, can initially be more difficult to address. Layering ESG goals on top of an existing building can be like fitting a round peg in a square hole. First, can anything be done to address the long-term commitments that have already been made? With enough time and money, existing buildings can be flood-proofed, structural components can be modified, building envelopes can be re-clad, and reparations can be made to underserved communities. If prior commitments can’t be addressed, it may mean responsibly abandoning the asset by either repurposing the building for another function (adaptive reuse) or disassembling the building for reuse, repurpose, or recycling. ESG solutions at a portfolio scale take time to execute and having a strategic plan for how to shift your portfolio over time is key. A good strategy will consider the level of urgency behind the program, the capital investment needed, and optimizing interventions for impact, cost, timing, and local market conditions.

Both new and existing buildings alike will need to address the growing need to collect data accurately and effectively for ESG reporting initiatives. Simply put, it is no longer sufficient to simply design a high performing building, we must now also monitor the building in real time and ensure that it is performing as intended. However, this has long been a dream for practitioners in architecture and urbanism. Not only does monitoring building systems provide operational savings, reduce risk, and improve efficiencies for our clients, it also provides designers with a learning tool to improve design standards and processes. While the promise of digital twins, artificial intelligence and intelligent buildings has brought us closer to realizing these dreams, general risk aversion in the industry has posed a challenge. Thankfully, the demand for enhanced ESG reporting may once again be the catalyst for change. ESG, architecture and urbanism are inextricably linked and coming together as one will allow us to redesign the sustainable cities of the future.